Inflation is a slippery concept, a positive feedback loop of pricing. It's the monster under economists' beds—too much of it, and your economy collapses; too little and it stagnates. While rising inflation is a legitimate concern, it's also something that companies can and do plan for.

Aided by trillions of dollars of fiscal stimulus deployed by governments around the world to fight the economic effects of COVID, inflation rates began to tick up by mid-2021 in many — but not all (more on this later) — markets, reaching levels not seen in decades.

Cost of inflation

Inflation eats away at the value a unit of currency can purchase. A dollar today cannot buy as much as a dollar yesterday. Projected forwards, a dollar today is worth more than a dollar tomorrow, not only because you could use that dollar and put it to use by investing it, but also because inflation will have eaten away at its value over time.

In the world of subscriptions, customers typically pay a fixed amount in regular intervals after having made a purchase decision on a pricing page from a set of available plans, usually differentiated by feature (think /basic/ vs /pro/) or time commitment (/monthly/ vs /annual/). From the point of view of the company selling the subscriptions, each new subscriber constitutes a new and hopefully /long/, sequence of future positive cash flows.

With a dollar in the future not being the same as a dollar today, the $20/month you charge customers will be worth less and less in real terms over time. Multiplied against your entire pool of customers, this can count for a lot. You can see where this is pointing. To compensate for the expected future losses in value, there is pressure on subscription prices to begin to rise where inflation is high.

Where is inflation high?

But where is inflation high? For those living in North America or Europe, inflation alarm bells are blaring and policymakers are jolting into action to address it. Across Asia however, inflation rates have so far remained mostly subdued. Meanwhile, in Argentina and Turkey, high inflation has been a fact of life for years.

Different inflation rates across different markets are a good example of why having fixed prices for everyone can often be a bad idea. And it's not just inflation that is putting pressure on prices. Local market conditions, such as expectations over which currency should be used to pay or local competitor prices, or even the willingness to pay of different user segments, all point to the need for subscription prices to be more flexible.

Yet unlike under many other sales models where prices are more malleable, businesses running digital subscription models have traditionally been comparatively shy to change prices. Some of this shyness is due to not wanting existing customers to reface purchase decisions by having to alert them of a price change. But another distinct source of shyness has been purely technical. Changing prices in today's subscription management systems, potentially across different geographies or segments of users, often involves non-trivial amounts of coordination across teams as well as engineering time to set everything up. It's simply not that easy.

Subscription prices and inflation

Not that the above has been much of a blocker. Subscription prices have steadily been increasing at 5% per year for the past decade, companies like Netflix have decreased prices in markets to match local willingness to pay and Duolingo has just announced in its quarterly earnings call that it plans to focus on charging country-specific prices.

And yet the tooling to be able to orchestrate these large-scale price experiments and measure their results is something which has thus far always been painstakingly built in-house and even then primarily by some of the most successful subscription companies out there. The ability to manage prices at scale like this makes companies that hold these capabilities flexible in responding to shifting willingness to pay and shifting macro variables like inflation across the world to make sure they continuously price more optimally.

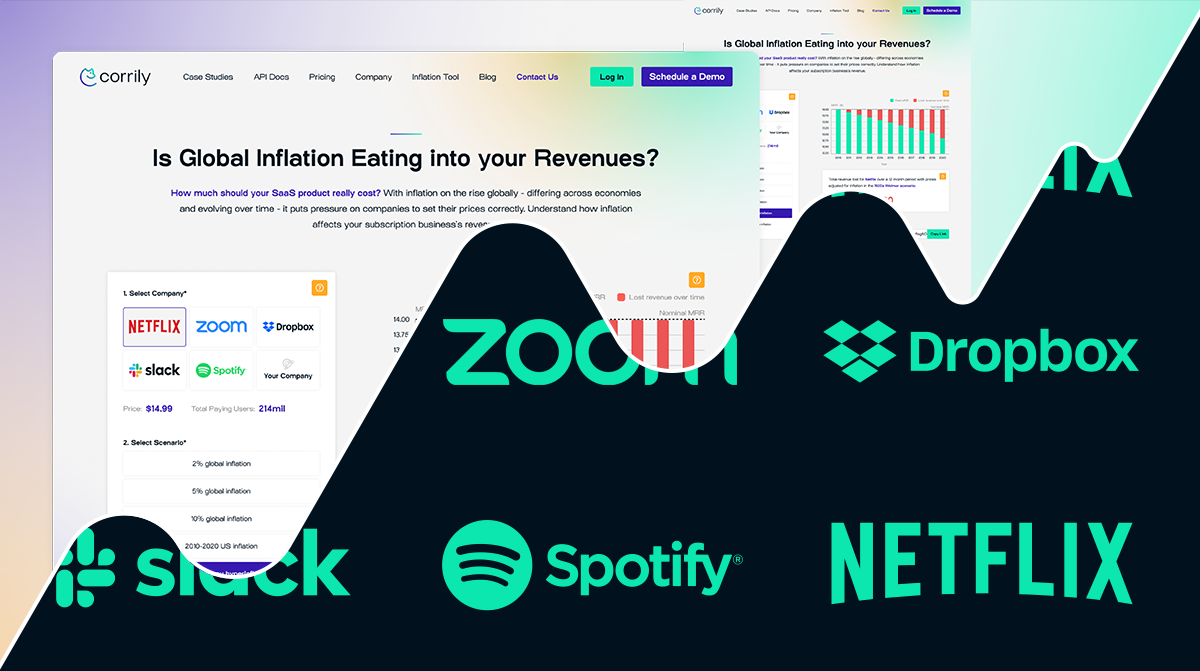

At Corrily, we're building a tool for country- and segment-specific price and coupon experimentation and management that takes a wide variety of factors into account, including inflation, when proposing prices and discounts to user segments. To help visualise the impact inflation could have on your subscription business, we have created a simple inflation tool you can use to study the impact that different inflationary environments could have on your future revenues.

Try out the Corrily Inflation Tool >