Need a Coca-Cola while having lunch?

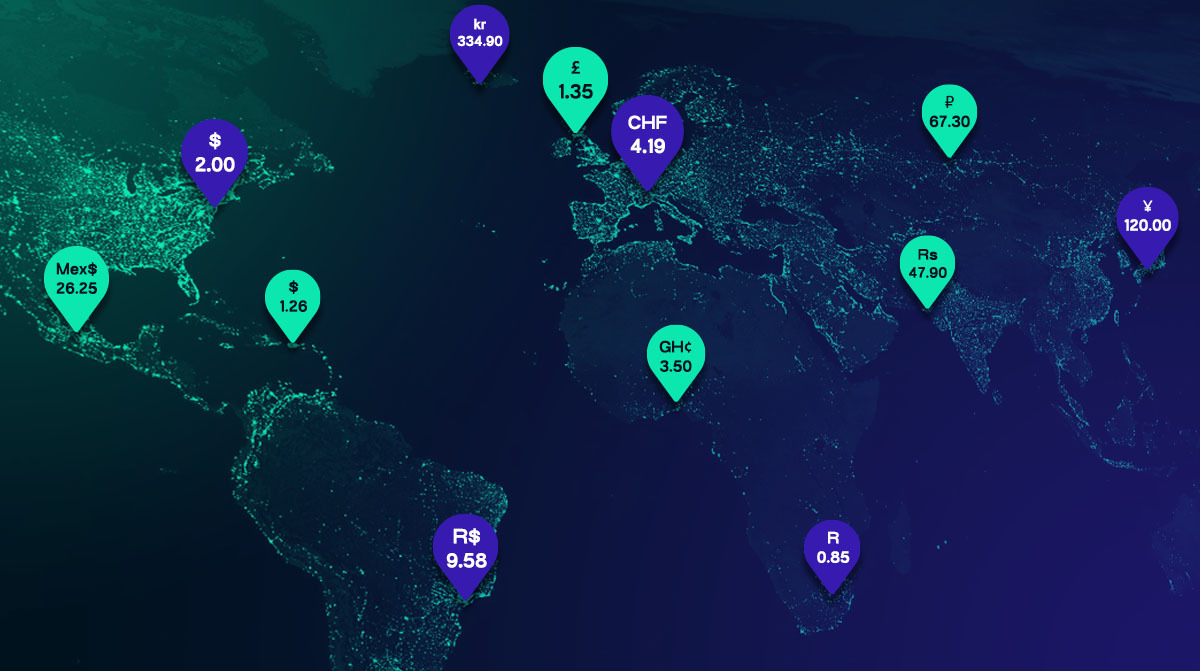

Depending on where you are, you could pay as low as $0.28 (Pakistan) or as high as $4.50 (Switzerland).

Why does Coke do this?

On a surface level, it’s simple: What one customer in country A is willing, and able, to pay differs from what another customer in country B is willing and able to pay.

But the reasons why a customer is willing to pay more are much more complex. Coke would consider a wide variety of factors when setting prices in local markets, including local taxes and import duties, local purchasing power, local transportation and transaction costs, and local perceived value of the product. Even cultural differences play a role, as some countries drink a lot more soda per capita than others. This concept is called “price sensitivity analysis.”

In this article, we’ll discuss how to price locally as you expand globally. You’ll learn what true price localization looks like and how to implement it.

More than converting currencies

91% of consumers say that they prefer seeing prices in their local currency. And it’s not just because they don’t want to deal with potential conversions and fees.1

Pricing in a local currency helps establish a price point that customers know and are comfortable with. Let’s say you were a payroll software company in the US expanding to Japan. It’s not enough to simply convert the price in US Dollars to Yen. This would be called Cosmetic Localization, but it fails to account for price sensitivity analysis, or what companies in Japan would be willing to pay for your payroll service. Price sensitivity analysis can tell you what price points are too cheap, a good value, or overpriced.

Equipped with such research data, you can discover the price point that would help you optimize your market share in Japan. Without such data, you risk losing potential customers or revenue because your price is too low or too high.

Market localization: The path to true price localization

There are two types of price localization. We discussed Cosmetic Localization in the previous section.

There are two big issues with this methodology:

- It’s overly simple and leads to odd price amounts that don’t take into account consumer psychology. For instance, a price of USD 9.99 in the United States is designed to optimize conversions; translating that into RMB 64.80 for China creates a price that’s not really designed to boost conversions.

- While the first issue can easily be fixed with rounding, it doesn’t factor in the unique characteristics of markets and their consumers, which ultimately hurts conversion rates. Remember the Big Mac index? That should teach you that pricing should be customized for each market.

The second type of price localization is Market Localization. This is where prices are adjusted to accommodate local willingness to pay, as well as to consider the different purchasing powers of each country.

In simple terms, this means that customers in Norway with a higher purchasing power may be willing to pay more than customers in the United States. Across regions and states, the prices of a product in one region may also vary with the prices in another area, even if the product is the same. Someone living in Denver with a lower average monthly salary would have a different willingness to pay than someone in San Francisco with a higher average monthly salary.

Cosmetic localization is easy. There are online tools that can instantly do it, and if you want to go manual you only need to convert your original prices into your target country’s local currency.

Market localization, on the other hand, is hard. It’s not as straightforward because it takes into account multiple factors. It requires thorough research and a deep understanding of the local market. But that work can prove more than worthwhile, as the right pricing helps maximize conversions and revenue.

A few months after rolling out localized pricing in select regions, Twitch saw immensely positive feedback from both viewers and creators that led them to expand to more regions worldwide.

Why market localization is more successful

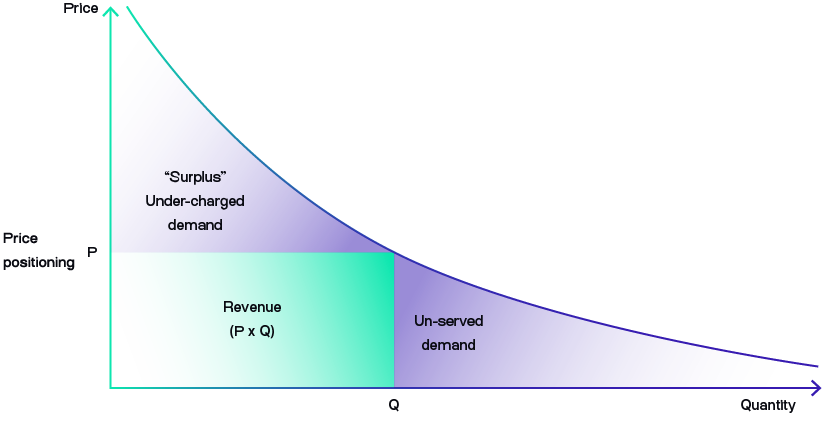

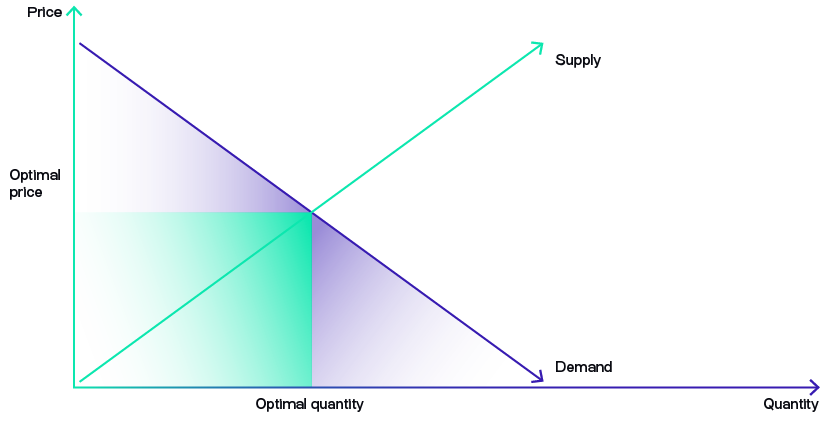

Take out that Economics 101 book and turn to the section about demand curves. It shows why you need market localization with your pricing.

Choosing a certain price point leads to a certain quantity, which will give you your revenue. If you only have one price, you’ll only capture the amount of revenue inside the rectangle.

The empty area to the right of the rectangle is your unserved demand. This means that you are priced too high for what customers in that segment are willing to pay. That’s lost customers and therefore, lost revenue.

The empty area on top of the rectangle is your undercharged demand. Your customers in that segment are willing to pay more than what you’re charging. That’s lost revenue.

Now, if you can price optimally for all of your customer segments, you can capture the entire revenue under the curve.

This is where market localization enters the picture. Market localization finds the right price by pinpointing a customer’s sensitivity to prices and their overall willingness to pay. Such market localization work can involve:

- Surveys and focus groups

- Revealed-preference experiments

- Conjoint analysis (how a product’s different aspects are valued)

After such research and analysis, you can set the price to minimize unserved demand and undercharged demand. And you’ll maximize conversions and revenue.

Doing price localization right

Market localization can optimize pricing and make your product or service more inclusive for international markets. It’s a win-win for you and your customers.

Unfortunately, companies typically pay large sums of money for engagements with consulting companies to help them determine prices internationally. These engagements take anywhere from 6 months to a year or even longer. That’s a lot of time and capital.

Figuring out purchasing power using online JavaScript indexes and packages are also other lower-cost options, but are both time-intensive, tedious, and often still incomplete.

The good news is that Corrily has streamlined the price localization process with a suite of pricing technologies and continuous experiments. The results speak for themselves. Our clients have achieved an average conversion rate increase of 45%—just by taking the time to do price localization right!

Footnotes

-

We surveyed 444 people and 404 responded saying they prefer to see prices in their local currency. Top reasons include 1. not having to manually convert, 2. easily understanding how much they’re paying, and 3. knowing if they’re still within their monthly budget ↩